Introduction: Hedge funds are a popular choice for high-net-worth individuals and sophisticated investors seeking potentially higher returns. However, before diving into the world of hedge funds, understanding their fee structure is essential. In this article, we will explore the intricacies of hedge fund fees, their components, and how they impact investor returns.

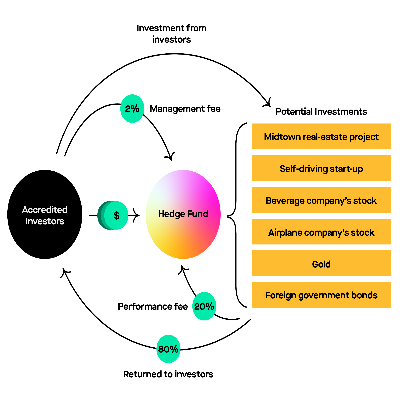

- The Basics of Hedge Fund Fee Structure: Investing in hedge funds involves several fee components. The most common fee structure includes the management fee and the performance fee, also known as the incentive fee. These fees are generally calculated based on a percentage of the assets under management (AUM) and the fund’s performance respectively.

- Management Fee: The management fee is charged by hedge fund managers for overseeing investment operations and covering administrative expenses. It typically ranges from 1% to 2% of the AUM and is calculated annually or quarterly. The management fee is designed to compensate managers for their expertise and provide a steady source of income.

- Performance Fee: The performance fee, also known as the incentive fee, is based on the hedge fund’s performance relative to a benchmark. It represents a share of the profits generated by the fund, typically around 20% of the excess returns generated above the benchmark. This fee aligns the interests of the fund managers with those of the investors, as it encourages them to maximize returns.

- High Water Mark: To prevent hedge fund managers from collecting performance fees for losses, the high water mark provision is often incorporated. This mechanism ensures that performance fees are only paid when the fund surpasses its previous highest value. Consequently, if the fund has faced losses in previous periods, the manager has to recoup them before becoming eligible for further performance fees.

- Additional Fee Components: In addition to the management fee and performance fee, hedge funds may charge other fees such as fund expenses, redemption fees, or wire transfer fees. Fund expenses cover direct costs associated with research, legal, compliance, and other operational activities. Redemption fees discourage excessive investor withdrawals, while wire transfer fees cover the costs of transferring funds.

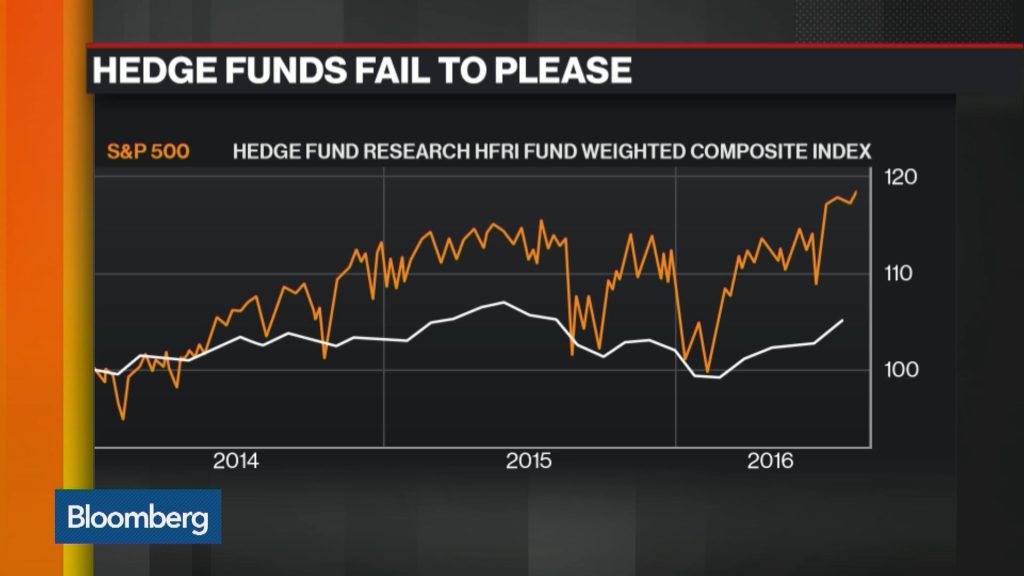

- Impact on Investor Returns: Hedge fund fees have a significant impact on investor returns. The combined effect of the management fee and the performance fee can considerably reduce the overall returns generated by a hedge fund. Therefore, it is crucial for investors to carefully evaluate the fee structure and assess its impact on potential returns before committing their capital.

- Factors to Consider: When analyzing a hedge fund’s fee structure, investors should consider various factors. These include the fund’s historical performance, risk-adjusted returns, reputation of the fund manager, investment strategy, and fee negotiation possibilities. Evaluating these factors ensures investors make informed decisions and select funds that align with their investment objectives.

Conclusion: Understanding the fee structure of hedge funds is crucial for investors aiming to maximize their returns. By comprehending the components, impact, and factors to consider, investors can make more informed decisions when allocating their capital to hedge funds. Careful consideration of fees, coupled with thorough due diligence, can ultimately contribute to successful investment outcomes in the complex world of hedge funds.

This comprehensive overview of hedge fund fee structures is a valuable resource for anyone interested in understanding this complex aspect of investing. The post delves into the various types of fees commonly associated with hedge funds and provides a clear explanation of each component.

The breakdown of management fees, performance fees, and hurdle rates offers readers a deeper understanding of how hedge fund fees work and the impact they can have on investment returns. The inclusion of examples and comparisons aids in illustrating these concepts further.

Investing in hedge funds can be intimidating for many due to the intricate fee structures involved. This post successfully demystifies these fees, allowing investors to make more informed decisions. It also highlights the importance of thoroughly understanding the fee structure before committing to an investment.

I appreciate the effort put into creating this comprehensive and accessible guide to hedge fund fee structures. It serves as a valuable reference for both experienced and novice investors seeking to navigate the intricacies of this investment vehicle.