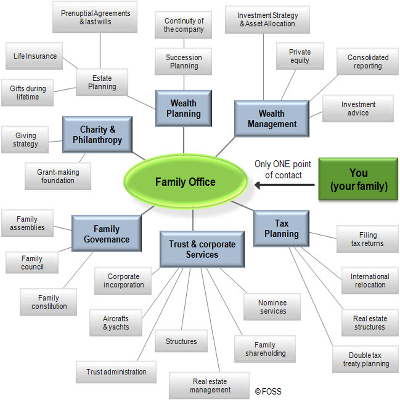

Introduction: Family offices provide comprehensive wealth management services to affluent individuals and families. Understanding the fee structure of a family office is a crucial aspect of engaging with their services. In this article, we will delve into the intricacies of family office fee structures, their components, and how they impact clients’ financial well-being.

- The Core Components of a Family Office Fee Structure: Family office fee structures typically consist of two primary components: the management fee and the performance fee. These fees compensate the family office for their services and expertise in managing the family’s wealth.

- Management Fee: The management fee is a percentage-based fee assessed on the value of the assets under management (AUM). This fee is charged to cover the ongoing operational costs and overhead expenses of running the family office. The management fee is usually calculated annually or quarterly and can range from 0.5% to 2% of the AUM.

- Performance Fee: The performance fee, also known as the incentive fee, is typically based on the family office’s ability to generate positive investment returns above a specified benchmark or hurdle rate. It is calculated as a percentage of the excess returns earned by the family office. Generally, performance fees range from 10% to 30% of the total investment gains.

- Additional Fee Components: Apart from the management and performance fees, family offices may charge additional fees for specific services or transactions. These fees can include financial planning fees, estate planning fees, tax planning fees, legal fees, and fees associated with other specialized services offered by the family office. It is essential for clients to review the fee structure carefully to fully understand any ancillary charges associated with the services provided.

- Fee Transparency and Customization: Family office fee structures are typically customized to meet the unique needs and requirements of individual clients. Given the personalized nature of family office services, fee structures can vary significantly from one client to another. Transparency in communication and a clear understanding of the services provided are crucial for clients to evaluate the value proposition of the family office’s fee structure.

- Evaluating the Value Provided: When assessing a family office fee structure, clients should evaluate the value provided in relation to the services offered. Factors such as investment performance, risk management, access to exclusive investment opportunities, and the expertise of the family office’s professionals should be carefully considered. Clients should also compare fee structures across different family offices to ensure they are receiving competitive and fair compensation for the services provided.

- Long-Term Relationship and Trust: Engaging with a family office entails forming a long-term partnership based on trust and open communication. It is essential for clients to conduct thorough due diligence and engage in comprehensive discussions regarding fees and services before entering into a relationship with a family office. This ensures the fee structure aligns with the client’s expectations and objectives.

Conclusion: Understanding the fee structure of a family office is crucial for individuals and families seeking comprehensive wealth management services. By comprehending the components, considering additional fees, evaluating the value provided, and establishing trust-based relationships, clients can make informed decisions that meet their financial goals. Clear communication and transparency in fee discussions are pivotal for successful engagements with family offices.