Introduction: When it comes to property management, understanding the fee structure is crucial for property owners and investors. A well-structured fee arrangement ensures fair compensation for property management services while maximizing returns. In this comprehensive guide, we will delve into the details of property management fee structure, its components, and how it impacts property owners.

- The Two Main Components: Property management fees typically consist of two key components: the management fee and additional fees. These fees cover a range of services provided by property managers and are essential for the smooth operation and maintenance of investment properties.

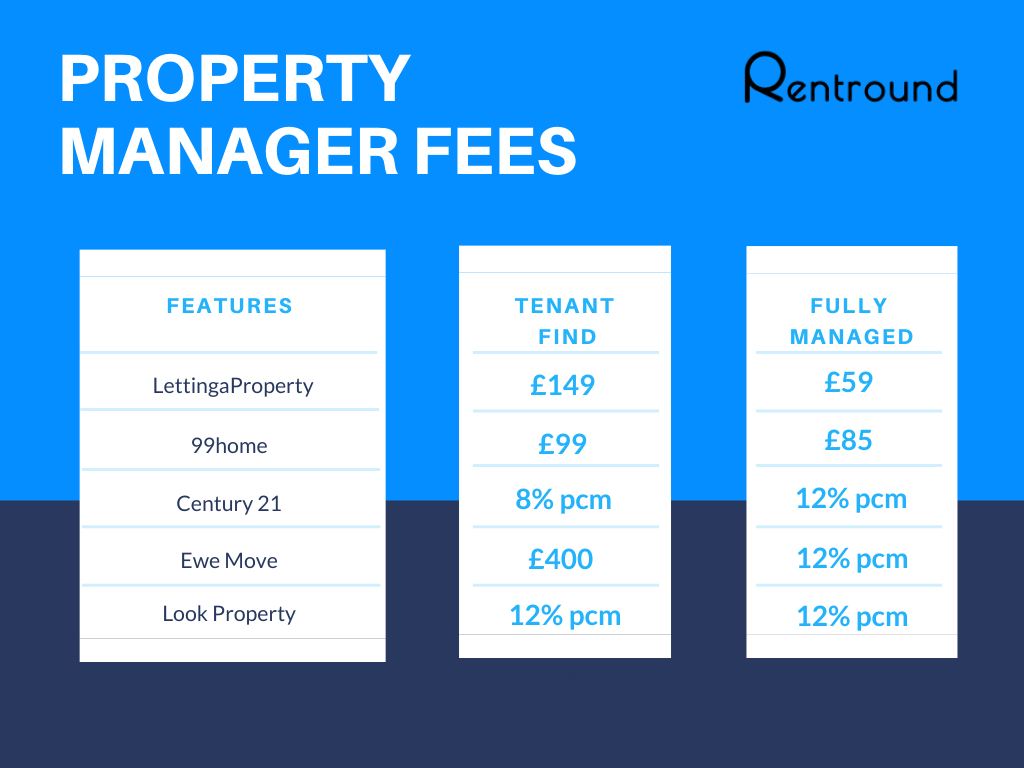

- Management Fee: The management fee serves as the primary source of income for property management companies. It is typically calculated as a percentage of the property’s rental income, commonly ranging from 8% to 12%. This fee compensates property managers for tasks such as tenant screening, rent collection, property inspections, maintenance coordination, and financial reporting.

- Additional Fees: In addition to the management fee, property managers may charge additional fees for specific services or expenses. These fees can include leasing fees (charged when a new tenant is secured), eviction fees, maintenance fees, and lease renewal fees. It is crucial for property owners to review the fee structure carefully to fully understand any additional charges associated with property management services.

- Factors Influencing Fee Structure: Several factors influence property management fee structures. These include the type of property (single-family home, apartment complex, commercial property), location, size, and complexity of the property. Additionally, market trends, local regulations, and the level of service provided by property management companies can also impact the fee structure.

- Aligning Fees with Services: Property owners should ensure that the property management fees align with the range and quality of services provided. It is essential to discuss and negotiate fees with prospective property management companies to find a balance that offers fair compensation while maintaining profitability.

- Importance of Property Management: Effective property management plays a crucial role in maximizing a property’s value and returns. The professional expertise of property managers helps maintain tenant occupancy, handle day-to-day operations efficiently, enforce lease agreements, and address maintenance issues promptly. Investing in quality property management services can help property owners mitigate risks and enhance profitability.

- Assessing the Fee Structure’s Impact: Property owners must carefully assess the impact of the fee structure on their investment returns. While lower fees may initially seem attractive, it is essential to evaluate the services, reputation, and track record of potential property management companies. Opting for the cheapest option may result in subpar service and ultimately affect property performance and returns.

Conclusion: Understanding the fee structure of property management is vital for property owners seeking professional management services. By comprehending the components, factors influencing fees, and the importance of property management, owners can make informed decisions to maximize their investment returns. Careful evaluation of the fee structure, coupled with thorough due diligence when selecting property management companies, is key for successful property ownership and management.